Your credit reports are full of sensitive, personal information — information that could be quite harmful if it fell into the hands of the wrong people. In a world where over 1.6 billion records were exposed through data breaches last year alone, being proactive about your credit privacy is not only smart, it’s downright essential.

Although it’s impossible to keep your data 100% safe from data breaches and would-be thieves, it never hurts to add an extra layer of protection to your credit reports. A fraud alert offers you a free and easy way to accomplish that goal.

What Is a Fraud Alert?

Fraud alerts are a free right given to you by federal law (the Fair Credit Reporting Act or FCRA). When you place a fraud alert on your three credit reports (Equifax®, Experian™, and TransUnion®), you make it more difficult for identity thieves to open fraudulent accounts in your name.

Fraud alerts let lenders who access your credit reports know that they need to exercise caution when issuing new credit in your name. With fraud alerts in place, lenders must confirm your identity before approving new credit which is attached to your Social Security number.

If a thief were to apply for credit using your information, he would hopefully be stopped when the lender reaches out to you (often on the phone number you provide) to verify that the application is legitimate and authorized.

Setting any type of fraud alert will never impact your credit scores in any way.

Check your free credit reports from all three consumer credit bureaus every 12 months at AnnualCreditReport.com. Look for fraud and mistakes and immediately report any you find.

Types of Fraud Alerts

You can place three different types of fraud alerts on your credit reports: initial fraud alerts, extended fraud alerts, and active duty fraud alerts.

Initial fraud alerts

This is the simplest type of fraud alert to place on your credit reports. Thanks to new federal law, an initial fraud alert may be placed on your credit reports for one year (formerly 90 days).

Extended fraud alerts

Are you already a victim of fraud or identity theft?

You may want to place an extended alert on your credit reports that will last for seven years. To do so, you’ll need to send proof to one of the three credit reporting agencies to show that you’ve already been a victim of identity theft. (Proof may be a police report or an identity theft report from IdentityTheft.gov.)

Active duty alerts

Active duty military members can add an alert to their credit reports that will require lenders to take extra steps before opening new credit in their names. These alerts also last for one year, but can be renewed to match the length of deployment. (Note: Unlike other fraud alerts, active duty alerts will remove your name from prescreened credit card offers for two years as well.)

How to Place a Fraud Alert on Your Credit Reports

Placing a fraud alert on your three credit reports is simple and free.

Fraud alerts are referred to as one-call alerts in the credit world. Even though the three major credit bureaus are entirely separate credit reporting companies, you only need to request a fraud alert from one of them (Equifax®, Experian™, or TransUnion®) to get the job done. Once you contact any one of the credit bureaus to request a fraud alert, it’s legally required to contact the other two on your behalf.

Initial alerts and active duty alerts can be placed easily online. But to place an extended fraud alert you’ll need to fill out a form, print it, and mail it to a credit bureau. Since each type of alert mentioned above lasts for a specified period of time, you should mark your calendar to remind you when the alert expires.

You can add a fraud alert to your three credit reports through any of the three methods below.

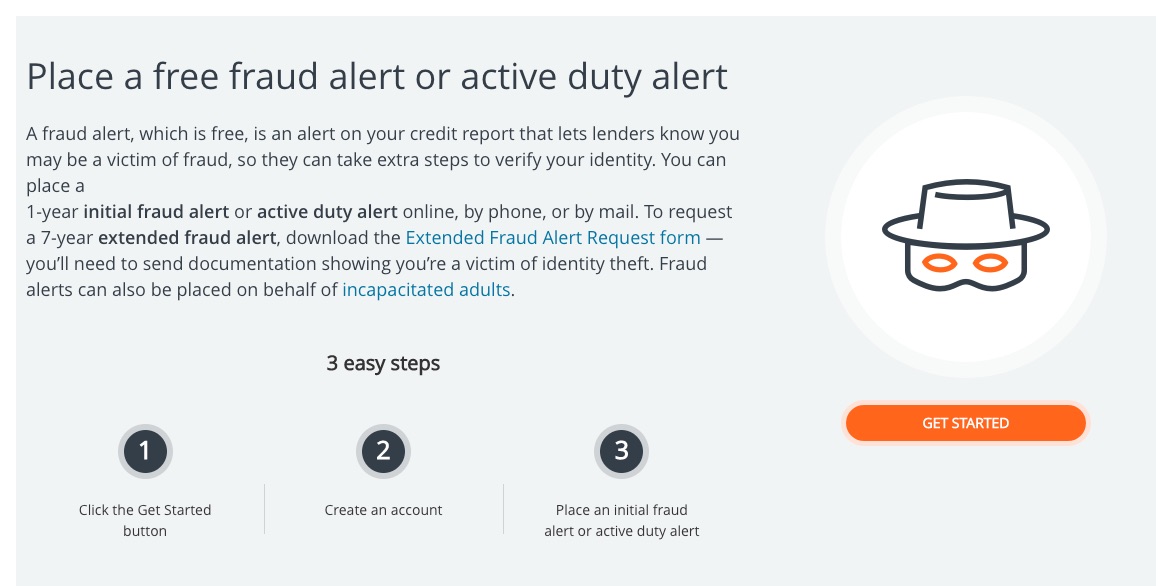

Equifax® fraud alert

Placing a fraud alert with Equifax®. Image credit: Equifax

- Step One: Visit Equifax Credit Report Services online

- Step Two: Select “Fraud alerts & active duty alerts” from the menu

- Step Three: Click the “Get Started” button

- Step Four: Create an account and verify your email address

- Step Five: Select “Place or Manage an Alert”

- Step Six: You can place an initial or active duty alert online. To place an extended fraud alert you’ll need to download and mail an Extended Fraud Alert Request Form

- Step Seven: Complete and submit the form to add fraud alerts to your three credit reports

- Alternate Option: If you prefer, you can dial phone number 1-800-525-6285 to place your initial or active duty fraud alerts

Experian™ fraud alert

Placing a fraud alert with Experian™. Image credit: Experian

- Step One: Visit Experian’s™ online fraud center

- Step Two: Select the “Add a fraud alert” option

- Step Three: Select the type of fraud alert you wish to add

- Step Four: You can place an initial or active duty alert online. To place an extended fraud alert you’ll need to download and mail an Extended Fraud Victim Alert Request Form

- Step Five: Complete and submit the form to add fraud alerts to your three credit reports. (Note: You are not required to enter an existing 10-digit report number if you enter your Social Security number instead.)

Alternate Option: If you prefer, you can call 1-888-EXPERIAN (1-888-397-3742) to place your initial or active duty fraud alerts over the phone

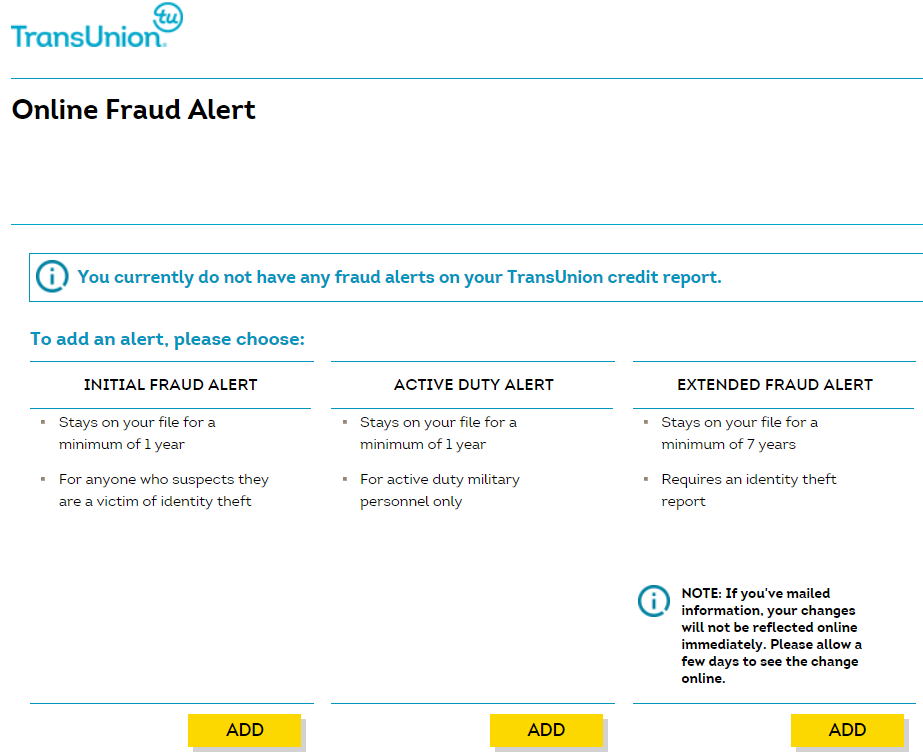

TransUnion® fraud alert

Placing a fraud alert with TransUnion®. Image credit: TransUnion

- Step One: Visit TransUnion’s® online fraud alert center

- Step Two: Select the type of fraud alert you wish to add and click the “Add Fraud Alert” button

- Step Three: Create a new account or log in to your existing TransUnion® account

- Step Four: Select (again) the type of fraud alert you wish to add and click the “Add” button

- Step Five: You can place an initial or active duty alert online. To place an extended fraud alert you’ll need to download and mail an Extended Alert Request Form

- Step Six: Complete and submit the form to add fraud alerts to your three credit reports

- Alternate Option: You can also call 1-800-680-7289 to place your initial or active duty fraud alerts over the phone

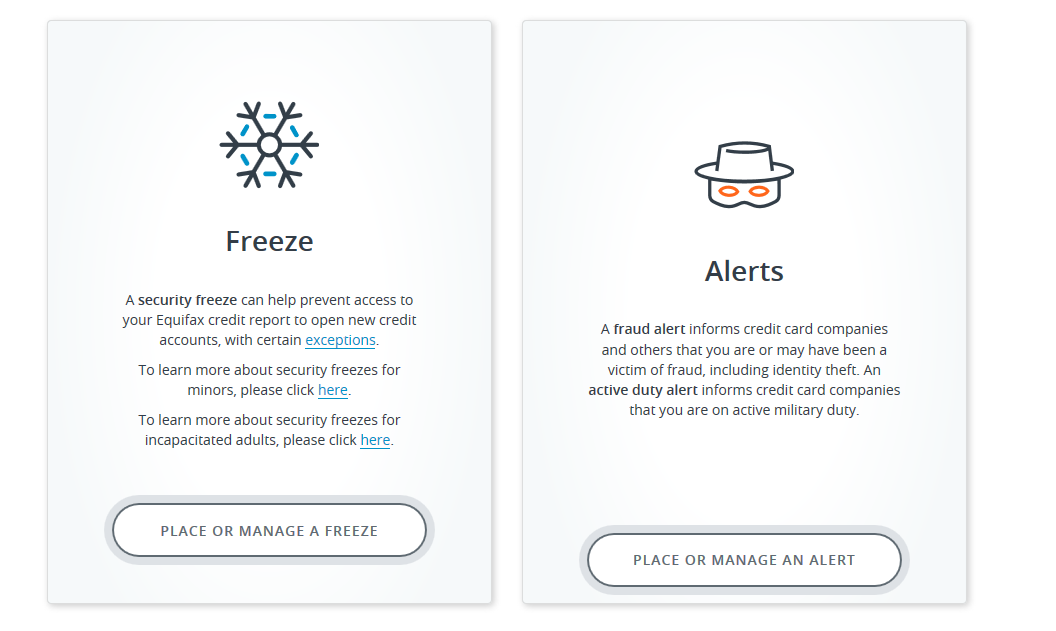

Fraud Alert vs Credit Freeze

Fraud alerts and credit freezes (also known as security freezes) are both tools you can use to proactively prevent true name fraud (aka fraudulent credit accounts opened without your consent). However, they don’t work exactly the same. Here is a look at some of the differences and similarities between fraud alerts and credit freezes.

Choosing a security freeze or fraud alert. Image credit: Equifax.

Similarities

- Both fraud alerts and credit freezes are free, according to federal law.

- Both fraud alerts and credit freezes may slow down the process of opening legitimate credit for yourself.

- Placing fraud alerts and credit freezes will not hurt your credit scores.

- Current creditors can still access your credit reports with fraud alerts or credit freezes in place.

- You might still receive pre-approved offers of credit with fraud alerts or credit freezes in place.

Differences

- You can place one-call fraud alerts by contacting any one of the three major credit reporting agencies. That credit reporting agency is responsible for notifying the other two of your fraud alert request. For credit freezes, on the other hand, you must contact each credit reporting agency individually.

- Fraud alerts have a time limit. A credit freeze usually stays in place until you remove it with your PIN.

- Fraud alerts provide lenders with a notice to contact you when your credit reports are pulled during new credit applications. A credit freeze takes your credit report(s) out of circulation so lenders cannot access them at all.

The bottom line is that both fraud alerts and credit freezes can be effective ways to protect you from becoming a victim of fraud. Credit monitoring for unauthorized activity can add a reactive type of protection as well (think defense instead of offense).

Credit locks are another type of credit protection, similar to credit freezes in many ways. Learn more about credit locks and credit freezes here.

Consider starting with a simple fraud alert and ramping up your protection from there. Remember, there’s no such thing as keeping your credit reports too safe from bad guys.